Introduction

Business interruption insurance is a form of protection that covers lost revenue when a company is closed due to physical harm or loss, such as that brought on by a fire or other natural disaster. This kind of insurance covers running costs, migration to a temporary residence if it becomes necessary, payment of taxes, and loan repayment. Business interruption insurance may occasionally be applicable when a company is shut down by a civil authority due to physical damage to a neighboring business, causing a loss for the company. If a business closes due to the spread of a pandemic, policyholders are not protected by the typical business interruption insurance policy. Some all-risk insurance contracts have specific exclusions for harm from bacteria or viruses.

What Is Business Interruption Insurance?

What is business interruption insurance? Like other business expenses, the cost of business interruption insurance (or, at the very least, the added costs of the insurance) is tax deductible. Only if the property/casualty coverage of the policy covers the reason for the loss in business income will this type of insurance pay up. The company's financial accounts often serve as the basis for calculating the amount due.

According to the insurance policy terms, business interruption insurance is valid until the end of the interruption period. According to the Insurance Information Institute, a typical policy has a 30-day expiration date but can be extended to 360 days with an endorsement. 1 Most commercial interruption insurance policies define this period as starting when the occurrence was first covered and ending until the damaged property is returned to its pre-catastrophe condition. There can also be a waiting period of 48 to 72 hours.

What Is Covered Under Business Interruption Insurance?

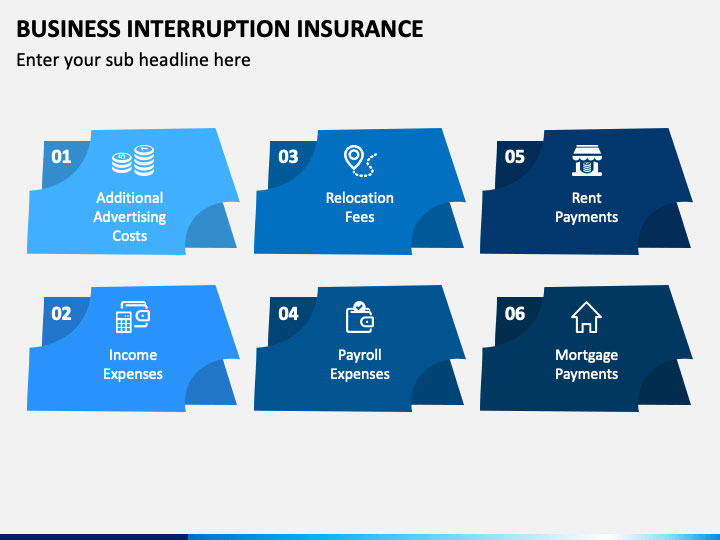

Your interruption insurance might help with the following running expenses if a covered loss forces your company to shut down:

- The average salary you'd receive from an open-ended business.

- Rent, mortgage payments, and lease fees for your firm's space.

- To pay for the time, you will have to make loan installments.

- Taxes, whether you pay them on a monthly or quarterly basis.

- The wages you pay your employees.

- Expenses associated with moving should you be forced to do so because of physical harm.

- Additional costs include when you need to rent a second location for your firm after a loss you have already covered.

- The price of training staff members to operate new machinery or equipment after a loss is covered.

Restoration Period for Business Interruption Coverage

The time frame during which your business interruption insurance will cover income loss is known as the restoration period. Typically, there is a 48–72 hour waiting period before your policy's income protection starts to take effect. Look up the procedure to determine when your restoration period starts and ends.

How Much Coverage Do I Need for Business Interruption Insurance?

There is a specific amount of coverage for each commercial interruption insurance plan. In the event of an expense, it is the sum you choose to acquire. Calculating how much business interruption insurance you'll need can be challenging. Utilizing your profits and predictions to predict future profits and calculate the right amount of insurance is a competent rule of thumb. Remember that you'll be responsible for any additional fees incurred if your business interruption expenses exceed the maximum coverage you choose. You can ask yourself the following questions to determine how much insurance you need:

- How long would it take your business to recover from a mishap or physical harm?

- Do your company's facilities have modern fire alarms and sprinkler systems?

- If you've lost anything, Do you believe you could find a new site in your area to rent out temporarily for commercial purposes?

A few insurances additionally cover business interruptions brought on by:

- those who can't enter your property to conduct business

- damage that occurs to a customer or supplier's property

- specialized insurance plans can protect your business's computers from hackers, malware, and other online dangers.

It is stated; that your business interruption insurance claim will cover the following expenses:

The situation affects your business's management costs, such as any additional accounting fees you might incur.

Business interruption insurance is typically offered as an additional option to business insurance plans, which combine several different policies into a single fee. In addition to building and content insurance plans, it is also a choice.

Conclusion

Only if the insured incurred costs due to the disruption is the insurer obligated to pay the claim. The amount paid by the company cannot exceed the maximum sum the insurance policy allows.