Introduction

Years spent in dealing with and analyzing the market have led financial market analysts and investors to rely on the much-studied P/E ratio and its various versions, which help paint a more precise picture keeping in mind the historical figures and future projections when considered over long periods. But the dangling market can lead to miscalculations or question the reliability of the P/E ratio, is P/E ratio trustable?

Overview:

For investors and financial analysts, the ratio is a mathematical formula used to determine how much value the stocks of a company have in the market. They may also use the ratio to compare the value of a company within the group of their industries or against the benchmark created by the market and analysts.

However, the companies with higher P/E ratios are not necessarily overpriced, but these companies are growing at a higher rate. In addition, investors believe these companies will grow faster than expected in the future, so they are inclined to pay an inflated share price for them at the current date. These investors are comparing the growth of these companies against the backdrop of the market and the group of industries to that companies belong.

How Do You Calculate Price-to-Earnings (P/E) Ratio?

In financial terms, P/E is a ratio comparing an organization's current share price to its earnings per share. The ratio discovers and then compares the organization's value to seek if it is overvalued or undervalued.

Mathematically, the ratio is presented in the following manner:

P/E Ratio= Earnings per share / Market value per share

Here, if a company pays all the profits earned to its shareholders, earnings per share would equal the portion of net income thus earned after paying the profits per share. Thus, Earnings per Share (EPS) indicates the financial stability of a company.

What's a Good P/E Ratio?

While considering what’s a good P/E ratio, the stocks are valued according to the price investors are willing to pay for them in current times based on their past or future earnings. A high P/E ratio can indicate that a company's stock is overvalued due to its high price relative to its previous or forecasted earnings. Reciprocally, a low P/E ratio can indicate that that company's stock is unvalued against its low price relative to its previous or forecasted earnings.

Understanding the Different Versions of P/E Ratio:

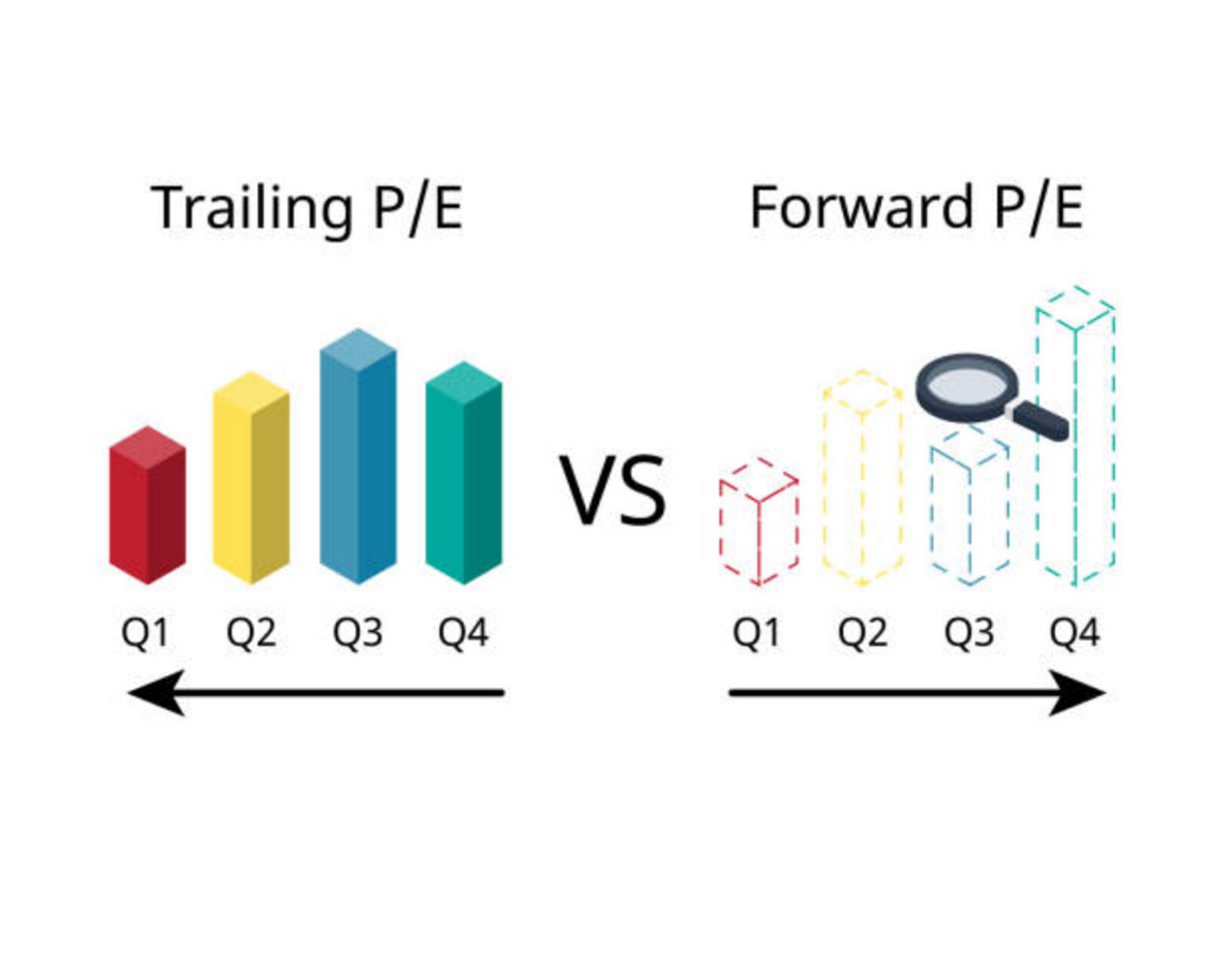

There are several versions or ways of representing the P/E ratio, depending on if we are calculating the P/E ratio based on the types of Earnings (per share) and in case the versions are considered based on forecasting the future earnings or earnings of the recent past.

Based on the above criteria, these versions of the P/E ratio are mentioned as follows:

Forward Price-to-Earnings Ratio:

Since the standard P/E ratio measures the net income in current times, the forward P/E ratios are calculated by estimating the company's net earnings for the next 12 months or a year. The ratio is also known as the Leading or Estimated Price-to-Earnings.

Trailing Price-to-Earnings Ratio:

The Trailing Price-to-Earnings Ratio is calculated by divulging the most recent previous twelve-month net income by the average share price of the common stock in the issue. This previous twelve-month period refers to the financial year of the company.

Trailing Price-to-Earnings Ratio from Continued Operations:

Using the Trailing Price-to-Earnings Ratio from Continued Operations, only earnings from ongoing operations are included, meaning earnings from discontinued operations, exceptional items like windfalls or write-downs, and changes in accounting standards.

Is the P/E Ratio a Reliable Indicator for Investors?

When deciding the value of stocks and even the price movement of stocks in the industrial market, the P/E ratio is not always a relevant factor due to market fluctuations in recent years. However, many supposedly stable and mature stocks have been criticized for being overvalued.

Experts suggest examining the stock ratios over long periods while also considering and adding the forward Price-to-Earnings Ratio for estimates and overall financial status, which is vital for the effective use of the P/E ratio as a reliable indicator for investors.

Conclusion:

Over time we wonder whether is P/E ratio trustable, but with experience, financial analysts and investors have learned to read the P/E ratio in moderation. So as not to raise the expectations for a rapidly rising or higher P/E ratio and lose hope as the P/E ratio stumbles towards a lower value. However, the importance of the P/E ratio lies in comparing the results of a company's stock to its industry benchmark.

Frequently Asked Questions (FAQs):

The following section answers a few of the most commonly asked queries on the topic of the P/E ratio and its reliability for investors:

Q: How does the P/E ratio help the investor?

A: The Price-to-Earnings or the P/E ratio helps the investor decide or compare an organization's current share price to its earnings per share.

Q: What’s a good P/E ratio?

A: A good P/E ratio indicates that a company may currently be overvalued or doing exceptionally well, as projected by its future trends. As companies with a higher P/E ratio grow their future earnings, investors expect higher returns or earnings in the times ahead from such stocks.

Q: Is P/E ratio trustable?

A: Since the P/E ratio is fundamentally derived from the recent past or the near future earnings per share, they are not always reliable investment indicators. Also, depending on the intentions or manipulated accounts and financial data by the internal or external analysts, these P/E ratios can be misleading to outsiders.

Q: Should I buy a high or a low P/E ratio stock?

A: If it is a small company or in a booming industry market, a high P/E ratio indicates a greater expectation from its future earnings. Whereas a company with a low P/E ratio indicates there are not much greater expectations from it, and there are chances that

Q: What if the P/E ratio is less than 10?

A: Because the P/E ratio cannot indicate a company's quality of earnings, a low P/E ratio of 10 or below only tells if the company has sold the shares at a cheaper price or it has low quality of earnings, and therefore, it may not be a good investment idea.